SARS tax for expats has been a hot subject over the last year. There has been an ongoing debate on how to go about SARS tax for expats. We’ve puzzled over these questions, often times not knowing which ones we need to put through the wringer.

Finally, SARS unshackled our brooding minds over Expat tax. SARS has given us a wonderful and well put together Q & A tax guide. This is the ebony to our ivory we’ve been waiting for.

SARS expat tax might apply to you if you are considered a tax resident.

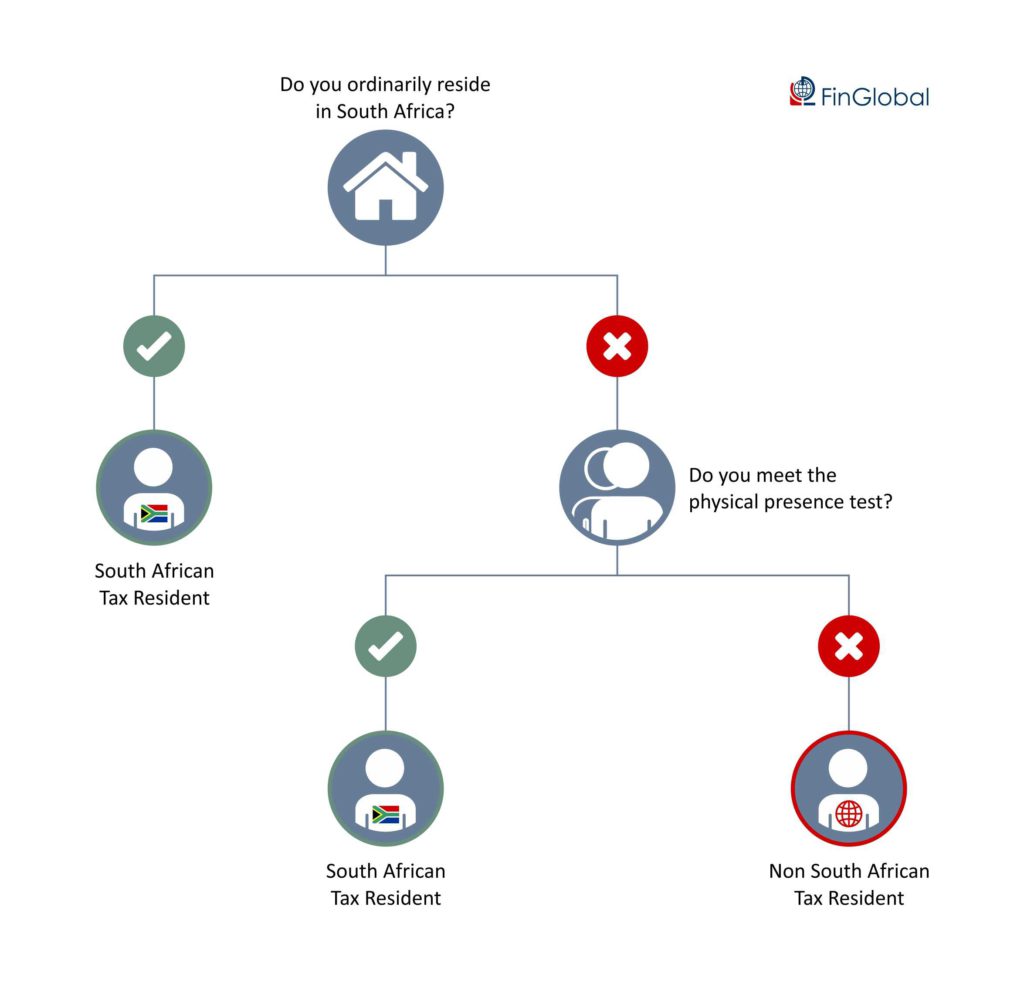

Before we proceed, keep in mind that your citizenship is not at all affected by your tax residency status. You are a South African tax resident if you (and your family) ordinarily reside in South Africa. You are also viewed as a South African tax resident by means of physical presence. SARS expat tax will be applicable to you if this is you.

To further assist you in your quest for residency status, use this straightforward infographic to determine if you are a South African Tax Resident or a Non-South African Tax Resident. Please see the colour coordinated questions applicable to your status.

To see the ordinarily resident and physical presence test, click here.

Great! Now that you have completed the questionnaire you can sit back, make a cuppa and have a read through the FAQ document and read up on what is applicable to you and your South African Tax residency status.

Financial Emigration vs Tax Emigration

A common myth out there is that once you have financially emigrated, you are exempted from paying tax, or are no longer a tax paying resident in South Africa. This myth is busted. Financial emigration does not equal tax emigration. Financial emigration nevertheless is not in vain.

Take a gander at some of the boastful benefits financial emigration offers:

- Easy access and transfer of your South African funds if you reside in abroad.

- Access to retirement annuity policies before maturity date.

- Simpler remittance of South African source inheritances.

FinGlobal provides premier financial emigration services and tax emigration advice to South Africans worldwide. Complete with 9 years of expertise and having the best in the field, we are here to help you with all your financial needs. Contact us today to find out how we can make your emigration transition easier for you and your family.

Bonus! SARS has also set up a correspondence address where you can directly come in contact with professionals in this area. Simply send an email to ForeignEmployment@sars.gov.za.