Is the question we’ll all be asking ourselves sooner or later…South Africans, living and working abroad, who rely on their policies back home should sooner question what effect time will have on their pension affordability.

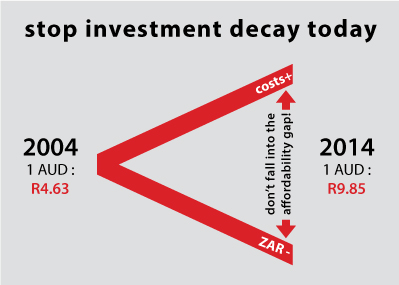

Relentless increase in cost of living combined with global aging simply means our retirement monies are going to have to last us longer. Given the equally relentless past decade of depreciation of the South African Rand relative to major international currencies it is inevitable for the currency to run out of affordability steam when we need it most!

Simply put – banking on international retirement in South African Rand 3, 5, 10 or more years from now present considerable risk. Why? The gap between cost of living and your Rand’s international buying power will only get bigger and bigger making retirement affordability nigh impossible.

The short-term solution: cash-in your South African policies now, because you can irrespective of age. Transfer the proceeds abroad and invest in a confident local currency – be it Australian, Canadian or US Dollar, Pound Sterling or Euros.

In the process – stop investment decay due to a depreciating Rand; don’t fall into the affordability gap courtesy future exchange at who knows what rate?

Take the opportunity to make a considered retirement decision. Get a free no obligation personal South African policy report to do the math. What have you got to lose?