Building and protecting wealth is about more than numbers, it’s about creating security, freedom, and opportunity for the future. For South Africans with global aspirations, an offshore trust can be the key to achieving all three.

By setting up offshore trusts for South Africans, individuals and families can safeguard assets, streamline succession planning, and access international investment opportunities, all while remaining compliant with South African tax and exchange control regulations.

Top 3 takeaways about offshore trusts for South Africans:

- Offshore trusts protect and grow your wealth — helping South Africans manage assets safely while staying compliant with tax and exchange control rules.

- Estate and succession planning made simple — offshore trusts allow you to pass on wealth smoothly, privately, and according to your wishes.

- Access global investment opportunities — diversify across borders and currencies while enjoying the flexibility and privacy offshore structures provide.

Explore more: How can an offshore trust protect your assets? What South Africans need to know.

Offshore trusts give South Africans the confidence to plan beyond borders and protect what matters most. Whether you’re focused on preserving family wealth, reducing risk, or growing your assets internationally, these structures offer real, practical advantages.

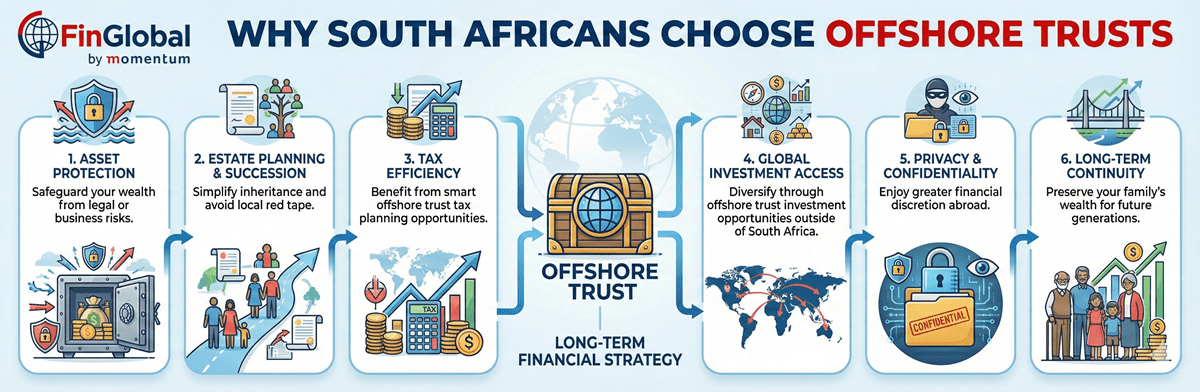

Why more South Africans are choosing offshore trusts as part of their long-term financial strategy:

- Asset protection – Safeguard your wealth from legal or business risks.

- Estate planning and succession – Simplify inheritance and avoid local red tape.

- Tax efficiency – Benefit from smart offshore trust tax planning opportunities.

- Global investment access – Diversify through offshore trust investment opportunities outside of South Africa.

- Privacy and confidentiality – Enjoy greater financial discretion abroad.

- Long-term continuity – Preserve your family’s wealth for future generations.

1. Offshore trusts for South Africans: protecting your wealth, wherever life takes you

An offshore trust is simply a legal structure set up in another country to hold and manage your assets for the benefit of your chosen beneficiaries, such as your family. You can also set up an offshore asset protection trust, which goes a step further by safeguarding your wealth from potential risks, like business liabilities, creditors, or legal claims. Because the assets in the trust are owned by the trustee (and not by you personally), they’re protected from these kinds of threats.

For South Africans moving or investing abroad, this can be a smart way to protect wealth in uncertain times. Whether it’s political changes, currency fluctuations, or market instability, an offshore trust adds a layer of security to help you preserve what you’ve built.

While there are costs involved in setting up an offshore asset protection trust, many people see it as a long-term investment in financial stability and peace of mind.

2. Offshore trusts can make estate and succession planning simple

Estate planning can be complicated, but setting up an offshore trust is a great workaround. It allows you to decide exactly how your assets will be managed and distributed after your death, without the lengthy delays, costs, and red tape that can come with the local probate process.

In simple terms, it’s a smoother, more efficient way to ensure your wishes are carried out. With succession planning via offshore trusts, you can decide when and how your beneficiaries receive their inheritance, whether you want to provide for them immediately, set conditions (like age or milestones), or plan ahead for future generations.

Read more: Protecting your assets and beneficiaries with a trust in South Africa: advice for expats.

So, what’s the difference between offshore trusts and South African trusts?

Not all trusts are created equal. Understanding the differences between South African trusts and offshore trusts can help you choose the right structure to protect your wealth, optimise tax efficiency, and plan for your family’s future.

Offshore trusts vs South African trusts: the pros and cons

| Feature | South African Trusts | Offshore Trusts |

| Legal jurisdiction | Governed by South African law | Set up in another country with its own trust laws |

| Taxation | Subject to domestic taxes and reporting | Tax efficiency possible with proper offshore trust tax planning for South Africans |

| Exchange control | Fully regulated under South African exchange control rules | Can provide more flexibility with cross-border investments (exchange control and offshore trusts SA) |

| Privacy | Often publicly recorded, limited confidentiality | Greater discretion; privacy with offshore trusts for South Africans is a key benefit |

| Investment opportunities | Limited to South African markets | Access to international markets; global investment via offshore trusts SA |

| Estate and succession planning | Subject to local probate and administration | Can simplify succession, reduce administrative hassle, and provide flexibility for beneficiaries |

| Cost and complexity | Usually simpler and lower cost to establish | May involve higher setup and ongoing management costs (cost to set up an offshore trust) |

| Control | Trustees typically local professionals | Can choose trustees with international expertise; structure can be customised to family needs |

In short, an offshore trust isn’t just a financial tool. It’s a forward-thinking way to protect your legacy, reduce administrative hassle for your loved ones, and ensure your wealth is transferred according to your exact wishes.

3. Offshore trusts are all about tax efficiency (in a legal, compliant way)

Let’s be honest; taxes are often the part that worries people most about offshore trusts in South Africa. But here’s the reassuring news: offshore trusts for South Africans are 100% legal, as long as you play by the rules and report them properly.

So, how are trusts taxed in South Africa? Generally, any income or capital gains passed on to a South African tax resident are taxed in that person’s hands. And when it comes to the taxation of foreign trusts in South Africa, even if the trust earns money offshore, those funds can still be taxable once they’re distributed locally.

This is where offshore trust tax planning for South Africans really makes a difference. With professional guidance, you can make sure your trust is structured correctly, stays compliant, and still works efficiently for your long-term financial goals. In other words, the taxation of offshore trusts isn’t about avoiding tax — it’s about understanding the rules so you can make smarter, more informed decisions.

4. Offshore trusts can expand your horizons through global investments

One of the biggest benefits of offshore trusts is the freedom to invest internationally. By holding your assets offshore, you can access a much broader range of markets, currencies, and sectors than you could locally.

This means you can explore offshore trust investment opportunities outside of South Africa that include international property, equities, funds, or even private investments that diversify your portfolio.

In fact, diversifying investments using offshore trusts is one of the best ways to manage risk – spreading your wealth across regions and economies to protect against local instability. That’s the beauty of global investment via offshore trusts SA: your money works harder, in more places, while you stay firmly in control.

5. Offshore trusts provide flexibility for globally minded South Africans

Families are increasingly global these days — children study abroad, careers span continents, and sometimes relocation becomes part of the plan. Setting up an offshore structure makes it easier to manage assets internationally.

How do you establish an offshore trust from South Africa?

- Choose the right jurisdiction – pick a stable country with strong trust laws.

- Appoint a trustee – select a reliable professional or trust company.

- Work with experts – use advisors familiar with South African and international compliance.

Which legal jurisdiction for offshore trusts is best for South Africans?

Some of the most respected jurisdictions include Jersey, Guernsey, Mauritius, and the Cayman Islands, because they all offer stability and strong legal frameworks.

If you’re setting up a trust in offshore jurisdictions from SA, it’s important to comply with exchange control and offshore trusts rules. This means getting the necessary approvals from the South African Reserve Bank (SARB) and reporting any transfers correctly. There are also reporting requirements for offshore trusts in South Africa. Beneficiaries and trustees must disclose foreign income, assets, and distributions to SARS. While it may sound complicated, a good advisor will ensure everything is above board.

Even with recent amendments to offshore trust rules in South Africa, the process remains straightforward when handled correctly — it just requires proper disclosure and recordkeeping.

Read more: What you need to know about the new rules on offshore distributions from South African trusts.

6. Offshore trusts enable privacy, confidentiality, and peace of mind

For South Africans looking to protect their legacy, offshore trusts provide both security and privacy. Unlike local trusts, offshore structures allow more discretion over your assets and who sees them.

At the same time, the rules of beneficial ownership apply to offshore trust, in order to ensure the trust is transparent for authorities while still keeping your family’s financial matters confidential. Partnering with experts in offshore trust tax planning for South Africans helps you manage these rules effectively, so your trust delivers peace of mind without compromising compliance.

FinGlobal: cross-border financial specialists for South African expats

Establishing an offshore trust in South Africa isn’t about avoiding responsibility — it’s about securing your legacy and creating opportunities for the future. Our team of cross-border financial specialists helps South Africans navigate every step of global wealth management, including retirement annuity encashment, international money transfers, tax emigration, and comprehensive cross-border financial planning.

With the right structure and expert guidance, you can enjoy compliant, strategic solutions that protect your assets, unlock global investment opportunities, and give you confidence that your wealth will benefit generations to come.

That’s the FinGlobal way — simple, secure, and tailored to your life, wherever you call home. To find out how we can help simplify your financial transition, contact us today.